virginia state retirement taxes

Others provide a specific deduction or exemption for Social Security retirement benefits. Permanently exempted groceries from the state sales tax in 2022.

Virginia Department Of Taxation

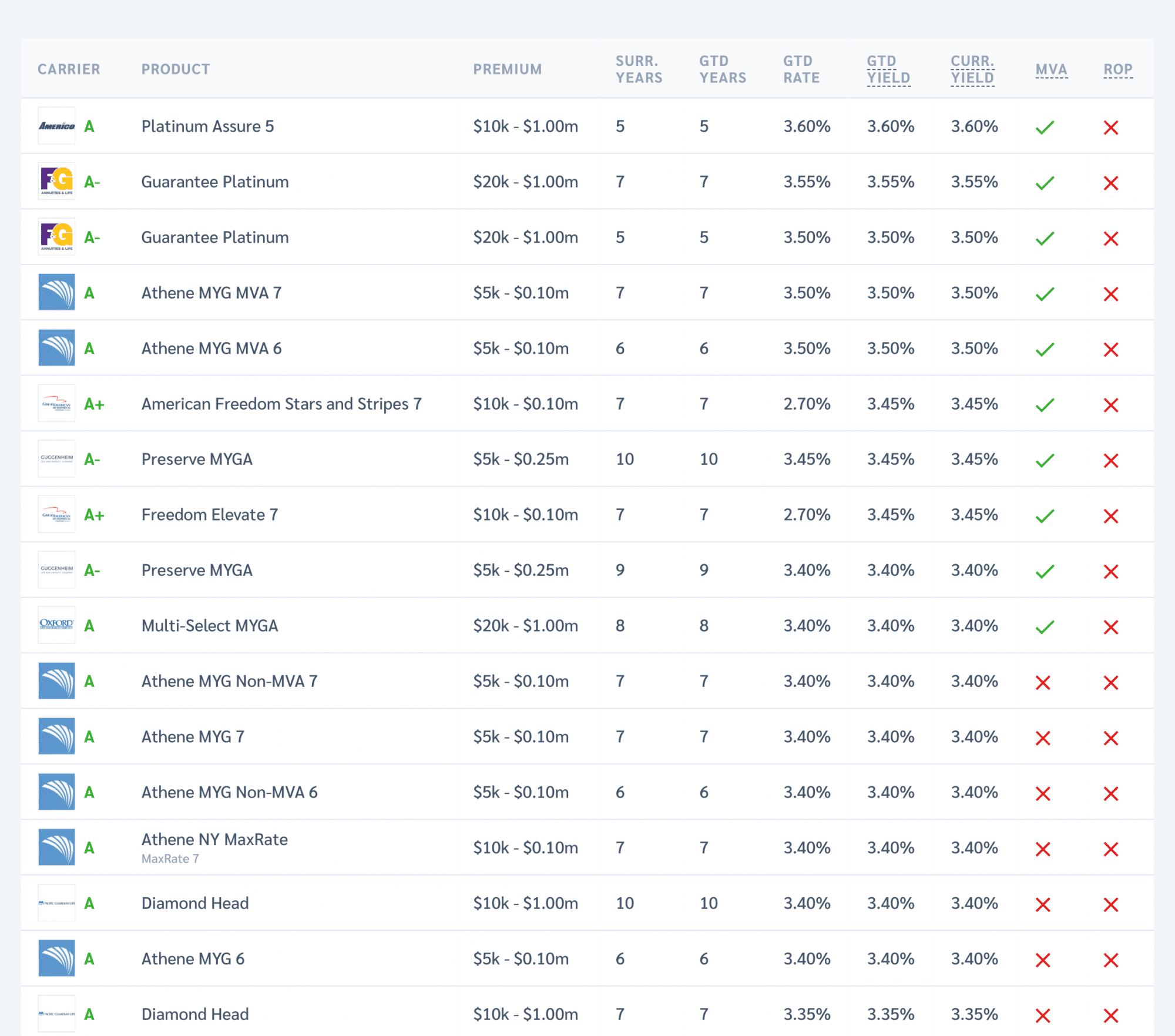

In the Virginia Retirement System pensions earned in Virginia are subject to state income taxes.

. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Capital gains from the sale of a home for example in Virginia are taxed as regular income which means they will likely face the top rate of 575. Fortunately Virginia has some of the lowest overall tax rates in the nation which makes it very attractive to retirees.

Beginning with 2022 Virginia individual income tax returns the standard deduction will increase to 8000 for single filers and 16000 for married. VRS accepts all forms by mail or fax. For tax year 2021 taxpayers.

State income tax rates range from 2 for up to 3000 of taxable income to 575 for incomes over 170002. Arizona considered a tax-friendly state for those who have retired exempts civil service retirement income from the states income tax. Joint filers can deduct 5290 if provisional income ie AGI plus nontaxable interest plus half of Social Security.

Virginias retirement system is among the top 50 largest public or private pension funds in the world. Remember the tax brackets are based on. Virginia military retirees 55 years and older will be able to keep more of their retirement income thanks to language in the state budget passed this spring by the states.

In Virginia all Social Security income is exempt from. All forms are fillable and ready for download and printing. If the value of your Basic Group Life Insurance is more than 50000 the cost of the.

Under the new law starting in 2022 Virginia is making up to 10000 in military retirement pay tax-free for those ages 55 and older. Virginia Capital Gains Tax. What is the Virginia state tax rate on retirement income.

The state income-tax deduction will. If you live outside Virginia contact your states taxation agency for information on state income taxes. The 12 states that tax Social Security are Colorado Connecticut Kansas Minnesota Missouri.

But you can deduct as much as 12000 on your return if you are at least. At one time or another pretty much everyone approaching retirement or early. Increased standard deduction.

The state tax rate ranges from 535 to 985. And because Virginia is a tax-friendly state for retirees it would behoove. State tax rates and rules for income sales property estate and other taxes that impact retirees.

A certain percentage of the Social Security retirement benefits that are taxable on your federal tax return will also be taxable on your West Virginia state tax return. The Virginia income tax rate tax brackets are.

Tennessee Retirement Tax Friendliness Smartasset

Form W 2 Explained William Mary

West Virginia Retirement Tax Friendliness Smartasset

Where S My Refund West Virginia H R Block

Finding A Tax Friendly State For Retirement Accounting Today

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Virginia Retirement Tax Friendliness Smartasset

Pension Tax By State Retired Public Employees Association

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

Virginia Income Tax Calculator Smartasset

States That Don T Tax Retirement Income Personal Capital

Virginia Retirement Tax Friendliness Smartasset

The 10 Best Places To Retire In Virginia In 2022 Personal Capital

15 States That Don T Tax Retirement Income Pensions Social Security

Which States Are Best For Retirement Financial Samurai

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates