income tax plus capital gains tax

1038Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. Here are the different taxes and the related rates.

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

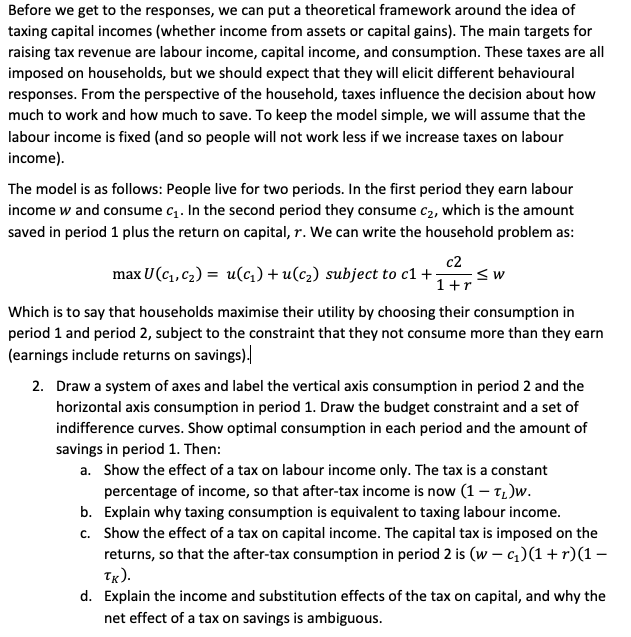

Under the current tax system capital gains are not adjusted for inflation meaning individuals pay tax on income plus any capital gain that results from price-level increases.

. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate. They are subject to ordinary income tax rates meaning theyre. By comparison a single investor pays 0 on capital gains if their.

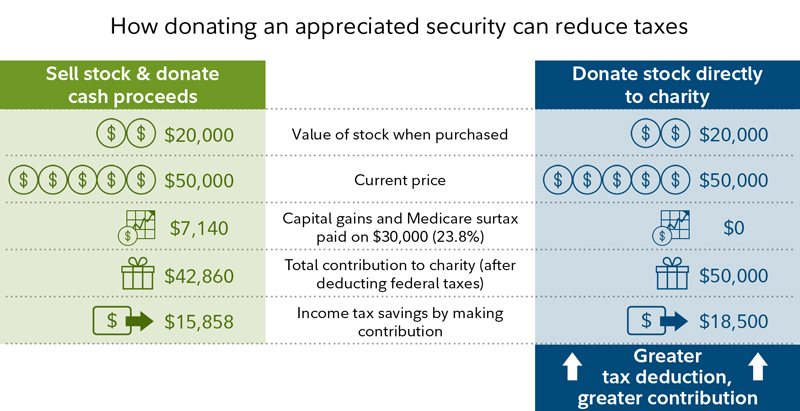

Tax rates on capital gains depend on how long the seller owned or held the asset. Short-term capital gains are taxed as ordinary income at rates up to 37 percent. The tax applies to high earners who receive capital gains income.

Capital gains are taxed same as. Governor Inslee signed the. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

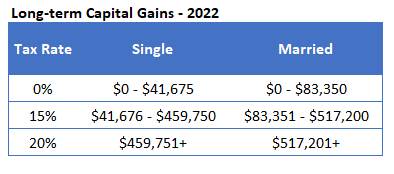

SFor 2021 a single filer pays 0 on long-term capital gains if their income is 40For 2022 the thresholds are slightly higher. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. Short-term capital gain tax rates.

4 days ago Aug 06 2022 Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and. The rate reaches 570 at maximum. When your other taxable income after deductions plus your qualified dividends and long-term capital gains are below a cutoff you.

Income tax rates from a low of 58 to 715. In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single tax filers with taxable. Taxes capital gains as income and the rate is a flat rate of 323.

Long-term capital gains on the other hand receive special tax treatment if you reach that one-year threshold. Total Capital Gains Tax. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital.

If you decide to sell youd now have 14 in realized capital gains. Maine has a variety of taxes. Short-term capital gains are gains apply to assets or property you held for one year or less.

How Much Is Capital Gains Tax on Real Estate. Taxpayers with modified adjusted gross income. Income from capital gains is classified as Short Term Capital Gains and Long Term Capital Gains.

Kansas taxes capital gains as income. Person effectively elects to include in each years income hisher pro rata share of the PFICs ordinary earnings and net capital gainsIf a QEF election. In April 2021 the Washington legislature voted to impose a state income tax.

2022 2023 Capital Gains Tax. Your tax rate is 0 on long-term capital gains if youre a single. Under the QEF election the US.

You pay 0 on long-term capital gains iAn individual must pay taxes at the short-term capital gains rate which i See more. The top federal long-term capital gains rate is 20 which is. Long-term gains are taxed at lower rates up to 20 percent.

In this part you can gain knowledge about the provisions relating to tax on Long Term.

2022 Income Tax Brackets And The New Ideal Income

Billionaires Income Taxes Are A Tiny Fraction Of What They Make White House Says Here S Their Average Tax Rate Marketwatch

An Overview Of Capital Gains Taxes Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home

How To Avoid Capital Gains Tax On Rental Property In 2022

State Taxes On Capital Gains Center On Budget And Policy Priorities

How To Avoid Capital Gains Tax On Real Estate Quicken Loans

Guide To The California Capital Gains Tax Smartasset

How Will My Capital Gains Be Taxed

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

A Guide To Capital Gains Tax On Real Estate Sales The Ascent By Motley Fool

Mechanics Of The 0 Long Term Capital Gains Rate

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

So This Question Is In Regards To Capital Gains Tax Chegg Com

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis